CUNA Mutual Group Zone Income™ Annuity

CUNA Mutual Group Zone Income™ Annuity from MEMBERS Life Insurance Company, provides an innovative approach to market-linked risk control combined with income for life. Zone Income lets you enjoy growth opportunities, without the worry of catastrophic loss.

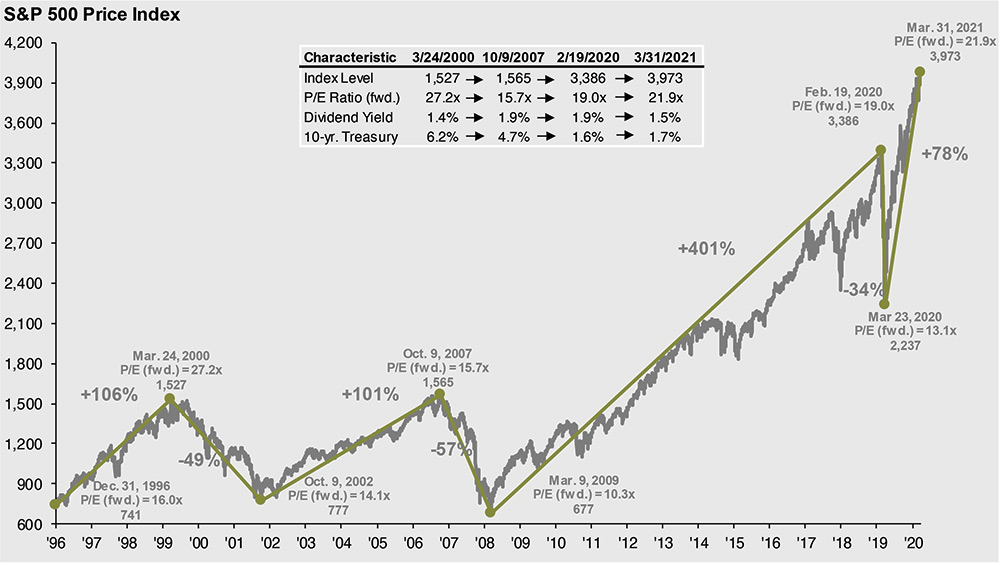

Source | FactSet, Compustat, Federal Reserve, Standard & Poor’s, J.P. Morgan Asset Management. Dividend yield is calculated as consensus estimates of dividends for the next 12 months, divided by most recent price, as provided by Compustat. Forward price-to-earnings ratio is a bottom-up calculation based on the most recent S&P 500 Index price, divided by consensus estimates for earnings in the next 12 months (NTM), and is provided by FactSet Market Aggregates. Returns are cumulative and based on S&P 500 Index price movement only, and do not include the reinvestment of dividends. Past performance is not indicative of future returns. Guide to the Markets – U.S. Data are as of March 31, 2021.

Why CUNA Mutual Group Zone Income™ Annuity?

- Guaranteed income with growth potential

- Confidence through market cycles

A personalized “comfort zone.”

Choose your allocations from three index options or a declared rate account. And you can make changes each year if your market outlook changes.

A guaranteed lifetime withdrawal benefit (GLWB).

You can begin receiving protected lifetime income while still growing your investment. You choose if your payment is for a single life, or for you and your loved one.

A way to leave a legacy.

Zone Income’s Return of Premium (ROP) death benefit ensures your loved ones will receive a sum equal to your original purchase payment, minus withdrawals made during your lifetime. It’s a dollar-for-dollar benefit.